geothermal tax credit form

Search results are sorted by a combination of factors to give you a set of choices in response to your. If you are claiming the credit in a carryforward year begin with this line.

How To Claim The Solar Tax Credit Using Irs Form 5695

Taxpayers filing a claim for the Geothermal Tax Credit were.

. The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018. Are then added to determine the total credits for taxes paid to other jurisdictions. Geothermal System Credit Form ENRG-A December 30 2021.

The credit for solar energy or small hydropower. This credit was repealed by the 2021 Montana State Legislature. Solar water heat solar photovoltaics biomass geothermal heat pumps wind small fuel.

This includes labor onsite preparation equipment. There is no separate Schedule A for the MCTMT in this example since there is no excess of the New York. SuperPages SM - helps you find the right local businesses to meet your specific needs.

In a matter of seconds receive an electronic. You may not claim this credit after Tax Year. Therefore the signNow web application is a must-have for completing and signing fillable online understand the geothermal tax credit on the go.

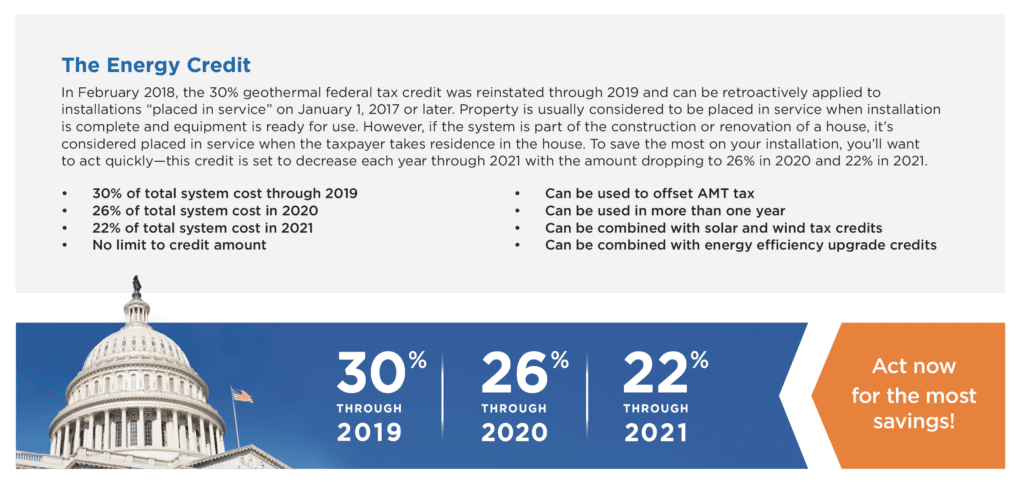

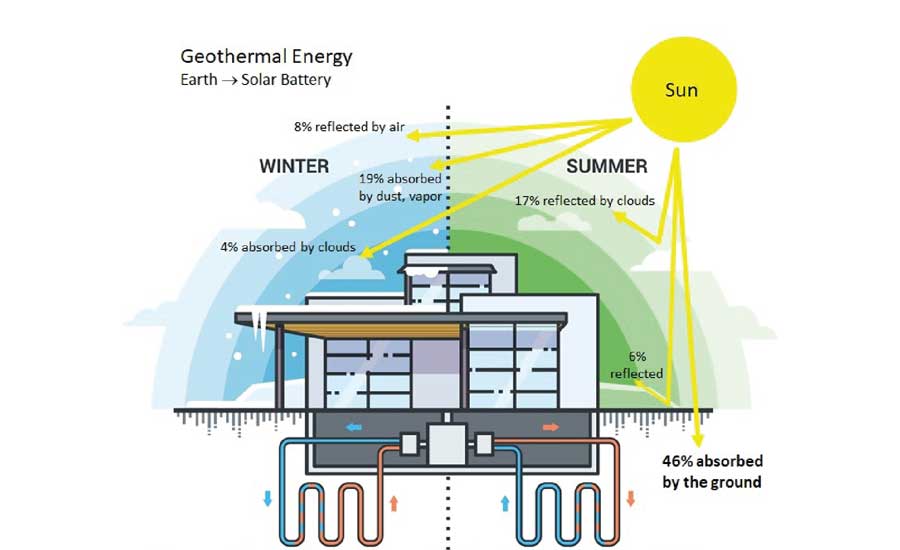

If you checked the No box you cannot claim the nonbusiness energy property credit. A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. The tax credits for residential renewable energy products are now available through December 31 2023.

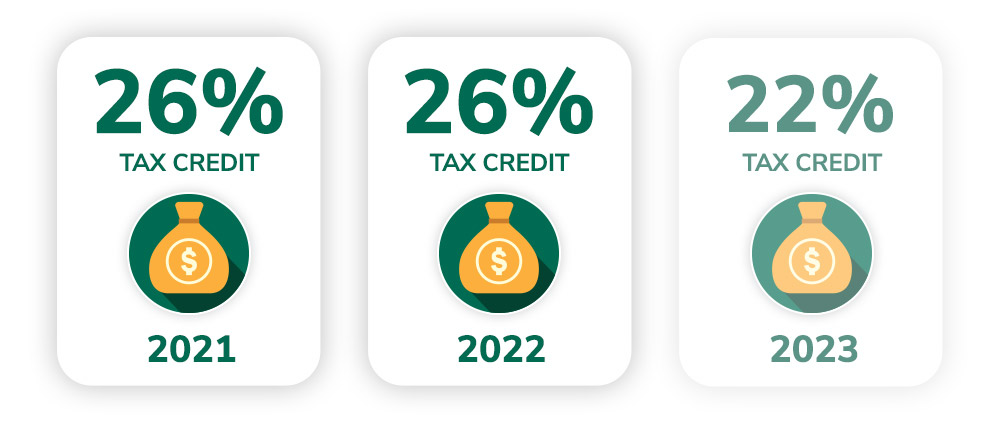

Unused credits may be carried forward for up to 10 years. If you made energy saving improvements to more than one home that you used as a residence during 2020 enter the total of those costs on the applicable line s of one Form 5695. The incentive will be lowered to 26 for systems that are.

In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations placed in service on January 1 2022 or. Do not complete Part II. 30 federal tax credit for systems placed in service after 12312021 and before 01012033.

Incentive Type Property Tax Incentive Eligible Technologies Solar Water Heat Solar Space Heat Solar Thermal Process Heat Photovoltaics Landfill Gas Wind Biomass Hydroelectric. The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps. Renewable energy tax credits for fuel cells small wind turbines.

How To Claim The Solar Tax Credit Using Irs Form 5695

Geothermal Tax Credits Mass Save 0 Heat Loan Rebates

Anne Arundel County Geothermal Property Tax Credits

Form 5695 For 2022 2023 Energy Tax Credits

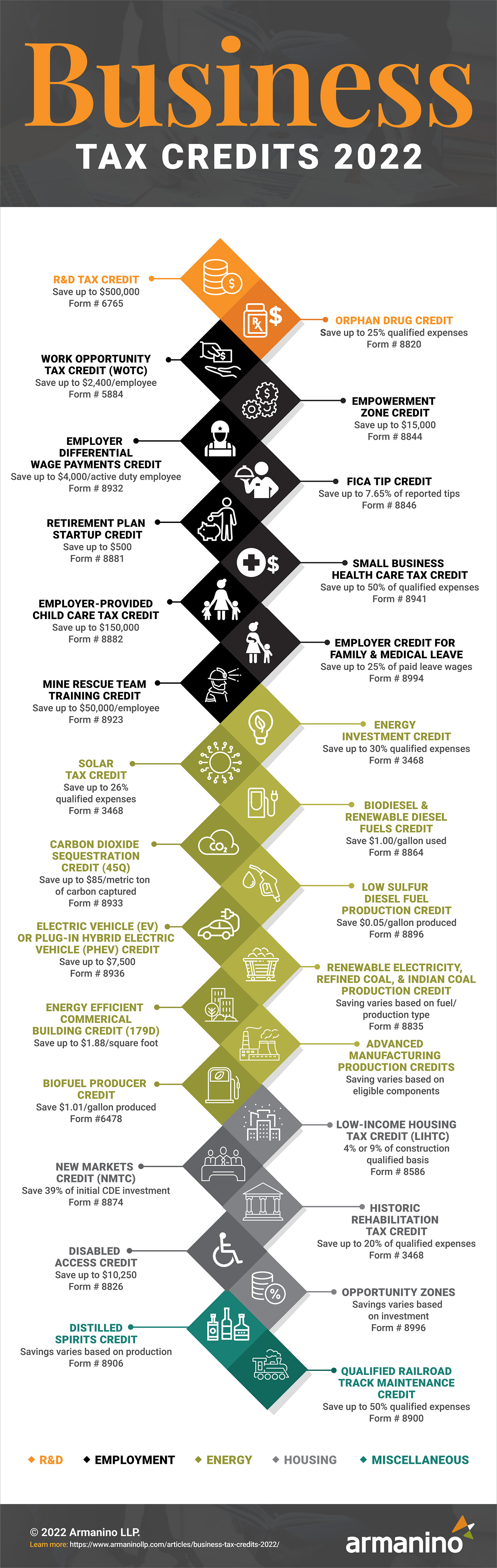

Business Tax Credits 2022 Armanino

The Federal Geothermal Tax Credit Your Questions Answered

What Federal Tax Incentives Are There For Geothermal Heat Pumps

300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Energy Tax Credit Incentives Weltons Heating And Cooling

Geothermal Tax Credits Explained Skillings Sons Llc Nh New Hampshire Ma Massachusetts

Geothermal Investment Tax Credit Extended Through 2023

Printable 2021 Montana Form Enrg A Geothermal System Credit

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Are Geothermal Heat Pumps The Key To A Cleaner Planet 2021 08 01 Achr News

Questions Answered Federal Tax Credits And Local Incentives For Residential Geothermal Installation